The US assault on Venezuela jolted the global commodity markets, sending gold higher and reinforcing the long-term bearish view on crude oil as investors navigate rising geopolitical tensions to start 2026.

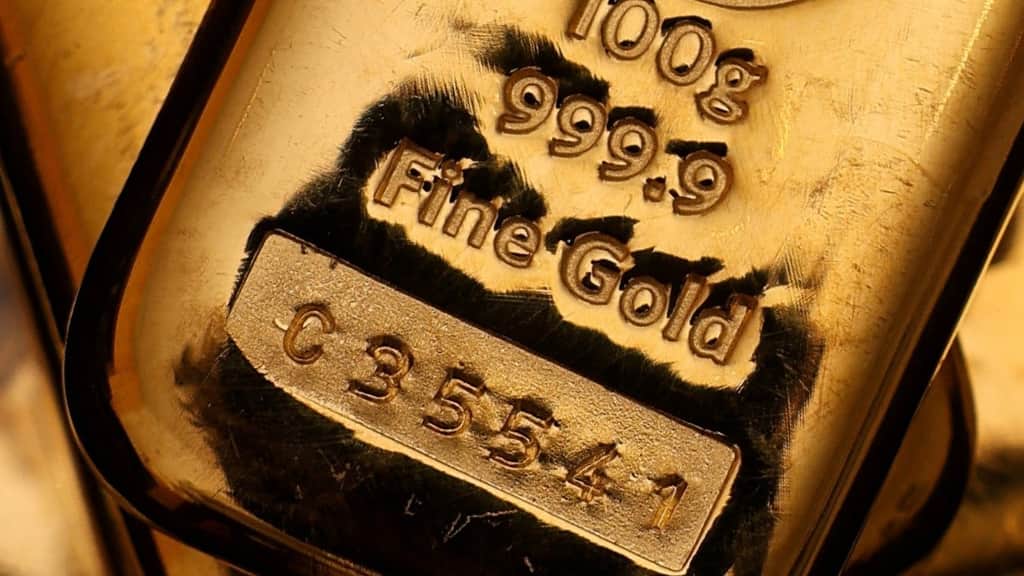

The weekend military raid on the South American country – home to the world’s largest oil reserves – added more weight to a call by Wall Street firms including JPMorgan Chase and Bank of America that gold prices would touch US$5,000 an ounce by the end of the year.

Franklin Templeton and Julius Baer said that crude prices would remain depressed in the long run if Venezuela returned to political stability and a ceasefire was struck between Russia and Ukraine.

The Venezuela episode came on the heels of a booming year for global commodities, with gold, silver and copper all hitting record highs in 2025 as interest-rate cuts in the US fuelled liquidity inflows and spurred demand. The Bloomberg Commodity Index rose 11 per cent last year, its best annual gain since 2022, while crude oil defied the uptrend with a 20 per cent decline on oversupply jitters.

“Gold is rising because nobody fully trusts the endgame of all this liquidity,” said Stephen Innes, a managing partner at SPI Asset Management. “Oil is struggling because there is too much supply.”

Gold and crude moved in opposite directions on Monday in response to the attack. The gold spot price rose by as much as 2.2 per cent to US$4,427.91 an ounce, closing in on its record high of US$4,533.21 last month. Oil futures fell by as much as 1.3 per cent to US$56.56 a barrel in New York.

Gold jumped 65 per cent in 2025 after the Federal Reserve delivered three quarter-point cuts in the interest rate, because the precious metal benefited from a low borrowing-cost environment as it generates no yield. The so-called debasement trade also drove up prices, with investors turning to gold as a hedge against bloating government debts among major economies.

Editorial Context & Insight

Original analysis & verification

Methodology

This article includes original analysis and synthesis from our editorial team, cross-referenced with primary sources to ensure depth and accuracy.

Primary Source

News - South China Morning Post