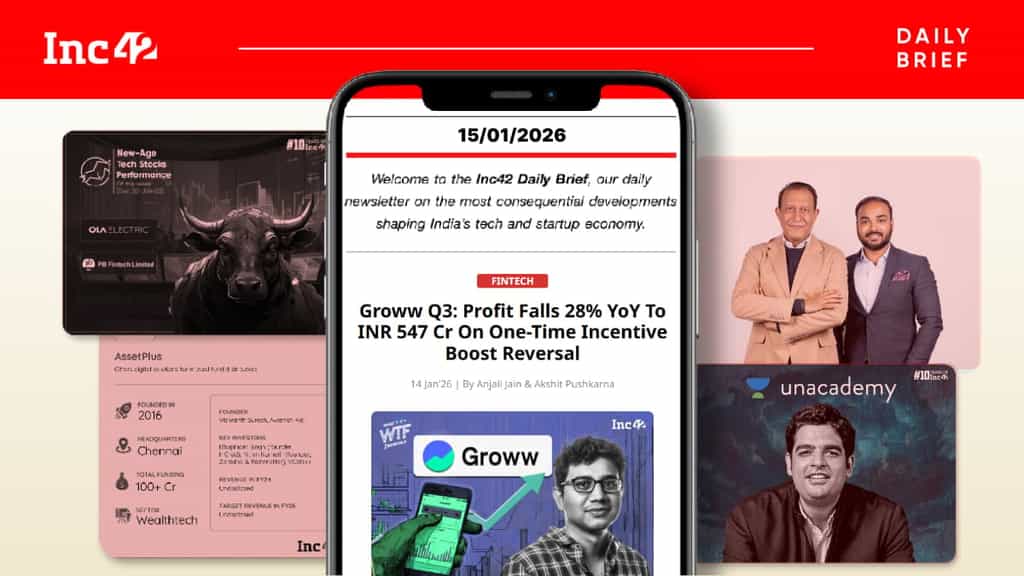

Groww delivered a volatile yet resilient performance in the third quarter of the ongoing financial year. The listed investment tech major’s profit took a hit due to certain exceptional provisions, while revenue accelerated through smart diversification and disciplined expansion.

The Profit Distortion: Groww’s headline profits slipped YoY due to the reversal of a long-term incentive, totalling INR 424.7 Cr due to its 2024 reverse flip to India. Core operations, however, remained strong as PAT growth outpaced revenue expansion. Meanwhile, the user base continued to grow and adjusted EBITDA rose steadily, signalling robust unit economics.

Diversification Bet Pays Off: For years, Groww’s primary engine was equity derivatives, but that dependency is rapidly fading. The company managed to nudge its massive user base toward its portfolio of wealth tech products, from commodity trading to loans against securities. These new bets, including MTF and Fisdom, saw revenue contribution improve by 10% in Q3.

The State Street Validation: On the same day, the listed unicorn also said that State Street Investment Management (SSIM) will acquire 23% in Groww AMC for INR 580 Cr. SSIM brings quantitative and passive strategy expertise to the table, while the infusion will strengthen the company’s balance sheet to pursue the “next phase” of growth and expansion.

While it remains to be seen how the global AMC firepower will fuel the listed unicorn’s next quarters, here’s how Groww fared in Q3.

Overseas jobs lure 3.9 Lakh Indian ECR (emigration check required) workers annually. But their journey is plagued by opaque processes, credential hurdles, visa delays and language gaps. BorderPlus is streamlining this path for healthcare professionals with its tech-led approach.

A Career Bridge: Founded in 2025, the Mumbai-based platform tackles cross-border employment friction head-on. Its model bundles finishing-school programmes, German language preparation, and documentation support to boost placement success and long-term employability.

A Strategic Foundation: In 2025, BorderPlus partnered with the National Skill Development Corporation for German language training and opened a Kochi centre backed by an INR 10 Cr scholarship fund. Initially targeting Germany’s regulated healthcare market, the platform has also expanded to the Middle East, with nurse onboarding slated later this year.

BorderPlus’ EU Ambition: Backed by $7 Mn in funding round from marquee names, the startup acquired German healthcare recruiter Onea Care last year, signalling its bid to scale up presence in the European Union. By building a permanent bridge between India’s workforce and overseas markets, the platform aims to redefine talent mobility. Can BorderPlus become the go-to platform for Indians seeking employment abroad?

The universe of listed new-age tech companies is expanding in India. Here’s a closer look…

Editorial Context & Insight

Original analysis and synthesis with multi-source verification

Methodology

This article includes original analysis and synthesis from our editorial team, cross-referenced with multiple primary sources to ensure depth, accuracy, and balanced perspective. All claims are fact-checked and verified before publication.

Primary Source

Verified Source

Inc42 Media

Editorial Team

Senior Editor

Dr. Elena Rodriguez

Specializes in Technology coverage

Quality Assurance

Associate Editor

Fact-checking and editorial standards compliance